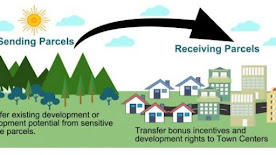

WHAT IS TDR? Transfer of Development Rights (TDR) means making available a certain amount of additional built-up area in lieu of the area relinquished or surrendered by the owner of the land, so that he can use extra built-up area either himself or transfer it to another in need of the extra built-up area for an agreed sum of money.

Purpose of TDR: The process of land acquisition in urban areas for public purpose especially for road widening, parks and playgrounds, schools, etc., is complicated, costly, and time consuming. In order to minimize the time needed and to enable a process, which could be advantageously put into practice to acquire land for a reservation purposes mentioned above.

Development Rights Certificate (DRC), whether transferable / Inheritable: If the owner of any land which is required for road widening for the formation of new roads or development of parks playgrounds, civic amenities, etc., those proposed in the plan shall be eligible for the award of Transferable Development Rights. Such an award will entitle the owner of the land in the form of a Development Rights Certificate (DRC). Which he may use for himself or transfer to any other person.

Zones of TDR: Based on the intensity of development, the the city is divided into intensively developed (A-zone), moderately developed (B-zone) and sparsely developed (C-zone) zones in the plan. The transfer of Development Rights shall be from intensely developed zone to other zones and not vice versa.

Comments